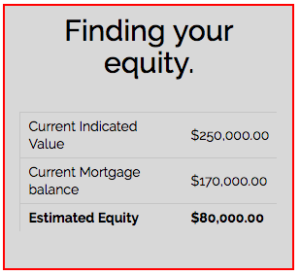

Your homes “Equity” is equal to the difference between what you currently owe on your home (total of all property liens) and its current value.

Two of the most common ways home owners can access a portion of their homes equity is to apply with a lender for a Home Equity Loan or a Home Equity Line of Credit.

Finding your equity.

A Home Equity Loan would be in the form of a single lump sum payout to the borrower.

A home Equity Line of Credit is a loan that is approved and available to the home owner, but no interest or payments are due until and unless the home owner utilizes some or all of the credit line. Checks or a credit card type access system is utilized by the borrower with a line of credit.

General Home Equity Awareness

- Although they are called Home Equity Loans or Home Equity Lines of Credit, they are secured by a lien against your property and in essence are a mortgage.

- Based on current Federal Law any interest payments on loans secured by a property lien are tax deductible.

- The costs involved in securing these types of loans are typically minimal. In many cases under $500.00

- You do need to qualify for these loans so your income and credit score may be reviewed.

- A common loan length or term is 15 years.

- Interest rates can be fixed or variable.

- In most if not all cases how and what you use the loan for is of no concern to the lender.

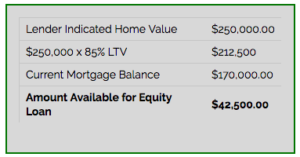

- A common cap or guideline most lenders us in determining the maximum amount of a Home Equity Loan is an 85% LTV (Loan To Value). Meaning the total loans or liens against the property cannot exceed 85% of the homes current value.

I have never been a big fan of Home Equity Loans. My professional exposure to these types of loans comes into play when I have a client who decides to sell their home. In many cases the bank has allowed the property owner to take out too much equity. The seller, after paying off their first mortgage, the equity loan and covering their closing costs is not left with enough money for a down payment on a home to replace the one they just sold.

I acknowledge and understand in some scenarios or to consolidate other debt a Home Equity Loan may be an option.

My strongest advice is to speak with a financial planner first. We all need to understand the long term ramifications and be aware of all options before tapping into our home’s equity.

RECEIVE YOUR MONTHLY VALUE MESSAGE

Our monthly value message is packed with useful information. You’ll be the first to know the latest market trends and current mortgage rates along with upcoming open houses that you can view.

I certainly will not share your information with anyone else and promise to send you only valuable and relevant information.